| INVESTING IS OUR STRONG SUIT |

A daily column on investing by Orbis Investment Management Limited

You may meet a senior representative from Orbis Investment Management Limited at the hotel. To make an appointment please contact the hospitality desk or call the Churchill Suite, room phone: 7554.

Hidden Value

![]() The topics that we have covered so far have

addressed general investment principles. At this stage, a real life

example of an investment from our portfolio should help to demonstrate

our value orientation. Fuji Electric of Japan is a fascinating company

particularly because of its overlooked assets.

The topics that we have covered so far have

addressed general investment principles. At this stage, a real life

example of an investment from our portfolio should help to demonstrate

our value orientation. Fuji Electric of Japan is a fascinating company

particularly because of its overlooked assets.

Fuji Electric is one of the world's leading electric equipment manufacturers. It founded and still owns a 12% stake in Fujitsu, a Japanese computer manufacturer and now Japan's largest Internet service provider. A close look at Fuji Electric and Fujitsu shows how investors act emotionally and thus illogically. It is opportunities such as this that we try to identify.

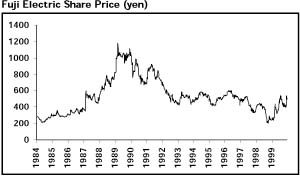

The Japanese recession caused Fuji Electric's earnings to collapse and the share price declined as a result. You will recall how we described the momentum investor as someone who is only interested in companies with earnings that are growing. When earnings stop growing they sell and move on. Admittedly things have not gone well for Fuji Electric recently and the company has not fully funded its pension plan obligations. However, in their haste to abandon their holdings of Fuji Electric we think that investors have overlooked the true value of the company. Not only has Fuji Electric begun to restructure its significant cost base and should thus return to profitability, but it contains the hidden gem of its Fujitsu interest. Fuji Electric should therefore be valued for both its earnings and its Fujitsu interest.

The problems that Fuji Electric has had with its recent earnings and pension liabilities have overshadowed the benefit of its interest in Fujitsu. At Fujitsu's current share price, the 12% owned by Fuji Electric is worth about 880 billion yen. If Fuji Electric consisted of nothing else you would expect each of its 715 million shares to be priced at about 1,232 yen each. Yet the share price of Fuji Electric is currently only 500 yen. Obviously the pension liability (about 250 yen per share), the lack of earnings performance and the tax it would have to pay if it sold its holding in Fujitsu are negatives. But even so, by our estimates this still offers a fantastic way to effectively buy Fujitsu at a significant discount and get an interest in the recovering Fuji Electric for free. Fujitsu is a very popular share. Its share price, typical of technology companies, reflects a very optimistic outlook for that company's future earnings. We would like to participate in the potential for this company but think the price is excessive. The Fuji Electric shareholding provides an opportunity to indirectly participate at a much-reduced price.

| Results | Contents |

|

|

|